We make tax continuing education simple

Experience the MTCO Difference

We know choosing the right tax education provider and the course is a big decision. In fact, choosing the wrong one could cost you or your clients thousands of dollars due to outdated material or uniformed instructors.

Whether you are a tax preparer participating in the Annual Filing Season Program (AFSP), need the Annual Federal Tax Refresher (AFTR), or are an Enrolled Agent (EA) choosing the best education partner is extremely important.

It’s essential to choose the best education partner. Your clients are your livelihood, your business, and your future. Don’t trust that to just anyone.

That is why we offer you the opportunity to experience one of our tax courses 100% free.

TRY BEFORE YOU BUY

Click Here To Claim Your Free CourseThink all tax courses are the same? Think again.

We’re giving you our top-rated $59 Federal Tax Update Course—FREE:

2025 Tax Brackets, Thresholds, and Inflation Adjustments. It’s a fast, focused 1-hour update with real-world insights on EV credits, deductions, and inflation shifts.

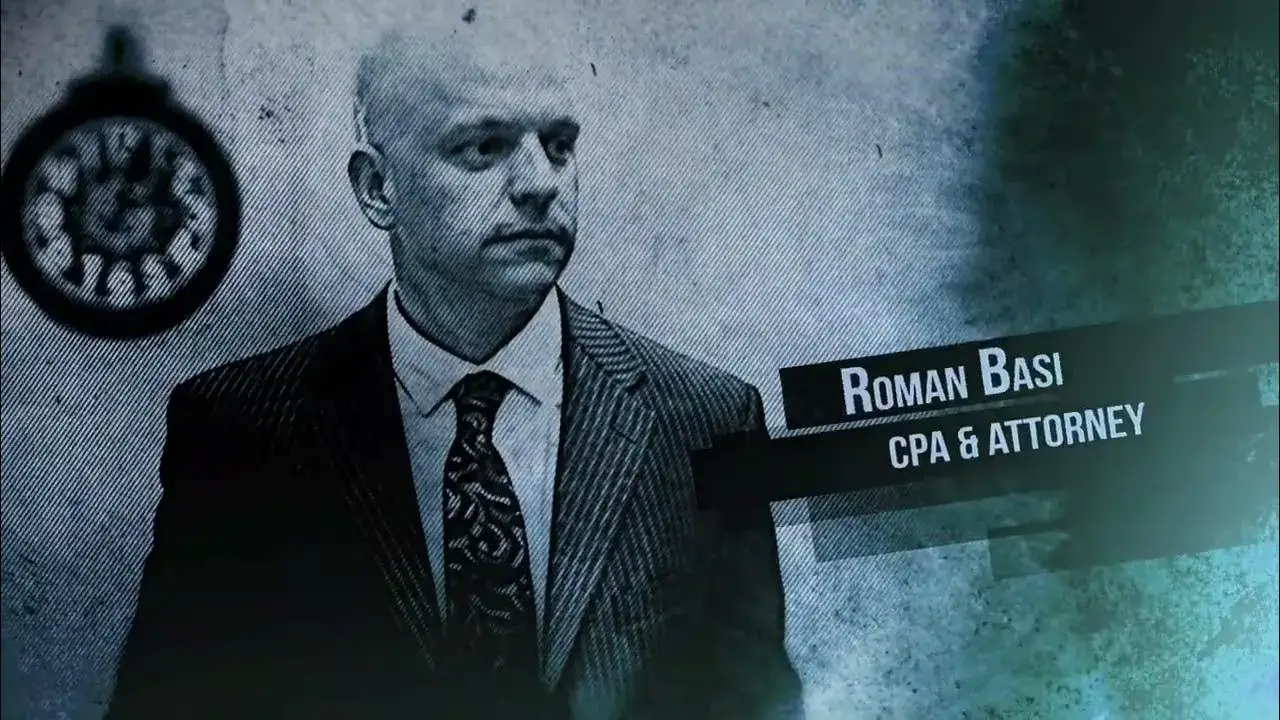

Why? Because we’re confident that once you experience the MTCO Difference—our engaging presenters, user-friendly all-video format, and comprehensive content—you’ll want the full package.

It’s not just free—it also counts toward your AFSP Record of Completion.