-

2026 Ultra Unlimited Package

2026 Ultra Unlimited PackageThe Ultra Unlimited Package is a comprehensive IRS-approved continuing education program designed for tax preparers. It provides unlimited access to an extensive range of courses covering federal tax See More

-

2025 Enrolled Agent 16-Hour Package

2025 Enrolled Agent 16-Hour PackageMaintain your Enrolled Agent Credential with our 16-hour package of IRS-approved courses. Top presenters cover cutting-edge topics in Federal Tax Law, Ethics, dispute resolutions, and more, with See More

-

2025 Enrolled Agent 24-Hour Package

2025 Enrolled Agent 24-Hour PackageThe 2025 24-Hour Enrolled Agent Package offers a thorough update on federal tax laws, ethical guidelines, and practical strategies. It includes expert-led courses on topics like IRS dispute See More

-

2025 16-Hour Enrolled Agent Choose Your Package

2025 16-Hour Enrolled Agent Choose Your PackageThis flexible, IRS-approved 16-Hour Continuing Education package is designed exclusively for Enrolled Agents (EAs) who want control over their learning while meeting IRS requirements. See More

-

2025 24-Hour Enrolled Agent Choose Your Package

2025 24-Hour Enrolled Agent Choose Your PackageThis IRS-approved 24-Hour Enrolled Agent CE package includes the required 2-Hour Ethics course. You then choose your remaining 22 hours from electives covering OBBBA, real estate taxation, See More

-

LIVE WEBINAR: 2/4: 2pm EST 2026 Tax Season Problem-Solving, with Live Q&A (2 Credit Hours of Federal Tax Law)

LIVE WEBINAR: 2/4: 2pm EST 2026 Tax Season Problem-Solving, with Live Q&A (2 Credit Hours of Federal Tax Law)Tax season brings more than just forms and deadlines; it brings real-world questions, unexpected situations, and high-impact decisions for taxpayers. The 2-hour Tax Season Problem-Solving, with Live See More

-

2025 Ethics Circular 230 (2 Credit Hours of Ethics)

2025 Ethics Circular 230 (2 Credit Hours of Ethics)This IRS-approved course provides a comprehensive understanding of the statutory, regulatory, and ethical standards outlined in Circular 230, a must-know regulation for Tax Preparers and tax Pros. See More

-

2025 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)

2025 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)Stay ahead with the latest 2025 Federal Tax Law Updates in this IRS-approved course. Whether you’re navigating new tax brackets, inflation adjustments, or retirement contribution limits, this See More

-

2026 Smart 1099 Reporting Practices & Updates (2 Credit Hours of Federal Tax Law) - Enrolled Agent

2026 Smart 1099 Reporting Practices & Updates (2 Credit Hours of Federal Tax Law) - Enrolled AgentRecorded on January 29, 2026, this in-depth course addresses critical updates to information return reporting for both 2025 and 2026. The session covers revised dollar thresholds, the IRS transition See More

-

2026 OBBBA Tax Season Update – What You Need to Know (2 Credit Hours of Federal Tax Law) - Enrolled Agent

2026 OBBBA Tax Season Update – What You Need to Know (2 Credit Hours of Federal Tax Law) - Enrolled AgentThis advanced technical update delivers an in-depth analysis of the most significant individual and business tax provisions enacted under the One Big Beautiful Bill Act (OBBBA). Recorded on January See More

-

2026 OBBBA Update With New Guidance (2 Credit Hours of Federal Tax Law)

2026 OBBBA Update With New Guidance (2 Credit Hours of Federal Tax Law)This comprehensive federal tax update is based on IRS guidance released at the end of 2025 and is designed to support accurate preparation of both 2025 and 2026 tax returns. While the One Big See More

-

2025 Maximizing The Home Office Deduction (2 Credit Hours of Federal Tax Law)

2025 Maximizing The Home Office Deduction (2 Credit Hours of Federal Tax Law)Home office deductions can be one of the more detailed areas in individual and small-business tax preparation. This self-paced course provides a practical explanation of IRC §280A, including the See More

-

2025 High-Impact Tax Savings for Middle-Income Earners (2 Credit Hours of Federal Tax Law)

2025 High-Impact Tax Savings for Middle-Income Earners (2 Credit Hours of Federal Tax Law)Taxpayers in the middle-income range face an evolving set of challenges, and opportunities, as new deductions, credit changes, and advanced planning issues emerge for 2025–2026. This course See More

-

2025 Tax Strategies for Middle-Class Taxpayers (2 Credit Hours of Federal Tax Law)

2025 Tax Strategies for Middle-Class Taxpayers (2 Credit Hours of Federal Tax Law)Middle-income taxpayers often feel stuck—earning “too much” for valuable tax credits and “not enough” to benefit from high-level planning strategies. This course bridges that gap and equips See More

-

2025 OBBBA Compensation, Payroll & Employment Provisions (2 Credit Hours of Federal Tax Law)

2025 OBBBA Compensation, Payroll & Employment Provisions (2 Credit Hours of Federal Tax Law)Get up to speed on the sweeping changes introduced under the One Big Beautiful Bill Act (OBBBA) that impact compensation, payroll, and employment benefits. Join Jason Dinesen, EA, for this essential See More

-

2025 Individual Planning: Trump Accounts, PTET, and SALT Planning (2 Credit Hours of Federal Tax Law)

2025 Individual Planning: Trump Accounts, PTET, and SALT Planning (2 Credit Hours of Federal Tax Law)This IRS-approved 2-hour course, “2025 Individual Planning: Trump Accounts, PTET, and SALT Planning,” will focus on how the 2025 tax season brings critical shifts in planning strategies, See More

-

2025 Ignorance & Bliss in Business Entity Selection (2 Credit Hours of Federal Tax Law)

2025 Ignorance & Bliss in Business Entity Selection (2 Credit Hours of Federal Tax Law)Choosing the right business entity impacts taxation, liability, and long-term planning opportunities. This IRS-approved continuing education course reviews sole proprietorships, partnerships, LLCs, S See More

-

2025 OBBBA’s Impact on Businesses (1 Credit Hour of Federal Tax Law)

2025 OBBBA’s Impact on Businesses (1 Credit Hour of Federal Tax Law)Stay ahead of critical tax shifts ushered in by the One Big Beautiful Bill Act. This course offers practical insights into permanent business tax reforms. From permanent 100% bonus depreciation and See More

-

2025 OBBBA’s Impact on Individual Filers (1 Credit Hour of Federal Tax Law)

2025 OBBBA’s Impact on Individual Filers (1 Credit Hour of Federal Tax Law)The One Big Beautiful Bill (OBBBA) has introduced sweeping changes to the U.S. tax code that directly affect millions of individual taxpayers. This IRS-approved course, led by nationally recognized See More

-

2025 Dr. Bart Basi’s Overview of the OBBBA (1 Credit Hour of Federal Tax Law)

2025 Dr. Bart Basi’s Overview of the OBBBA (1 Credit Hour of Federal Tax Law)The One Big Beautiful Bill (OBBBA), introduces new tax credits, extends key provisions, and brings forth further compliance and regulatory changes. In this one-hour course, renowned tax expert, Dr. See More

-

2025 Real Estate Tax Laws and Depreciation, Including OBBBA Updates (2 Credit Hours of Federal Tax Law)

2025 Real Estate Tax Laws and Depreciation, Including OBBBA Updates (2 Credit Hours of Federal Tax Law)Join nationally recognized tax expert Doug Stives for a comprehensive look at how real estate investors and property owners can maximize their tax benefits. This webinar counts for 2 Hours of See More

-

2025 OBBBA Key Highlights and Changes (2 Credit Hours of Federal Tax Law)

2025 OBBBA Key Highlights and Changes (2 Credit Hours of Federal Tax Law)The One Big Beautiful Bill (OBBBA), signed into law on July 4, 2025, brings major tax code changes that affect virtually every taxpayer. In this detailed and engaging course, tax expert Jason See More

-

2025 Mid-Year Tax Check-In (2 Credit Hours of Federal Tax Law)

2025 Mid-Year Tax Check-In (2 Credit Hours of Federal Tax Law)Get ahead of the year-end rush with this timely IRS-approved webinar designed specifically for tax professionals. Taught by nationally renowned instructor Doug Stives, this 2-hour session provides a See More

-

2025 Child and Dependent Care Credits (Form 2441) (2 Credit Hours of Federal Tax Law)

2025 Child and Dependent Care Credits (Form 2441) (2 Credit Hours of Federal Tax Law)Form 2441: Child and Dependent Care Expenses is frequently used but often misunderstood. Although it may appear simple, the form can present complex challenges, especially when dealing with real-life See More

-

2025 Itemized Deductions with Case Studies (2 Credit Hours of Federal Tax Law)

2025 Itemized Deductions with Case Studies (2 Credit Hours of Federal Tax Law)This IRS-approved continuing education course is designed for tax professionals participating in the Annual Filing Season Program (AFSP). "Itemized Deductions with Case Studies" provides an in-depth See More

-

2025 Schedule C Deep Dive (2 Credit Hours of Federal Tax Law)

2025 Schedule C Deep Dive (2 Credit Hours of Federal Tax Law)This IRS-approved course is designed for tax professionals who prepare returns for sole proprietors and self-employed individuals. Covering both timeless principles and new developments for 2025, See More

-

2025 International Tax Essentials: Sourcing Rules, Critical Forms & Global Trends (2 Credit Hours of Federal Tax Law)

2025 International Tax Essentials: Sourcing Rules, Critical Forms & Global Trends (2 Credit Hours of Federal Tax Law)In an increasingly global economy, tax compliance has become both more critical and more complex. This course will guide you through the core principles of the international tax system, including See More

-

2025 Essential Trust & Estate Tax Strategies to Protect Assets (2 Credit Hours of Federal Tax Law)

2025 Essential Trust & Estate Tax Strategies to Protect Assets (2 Credit Hours of Federal Tax Law)Estate planning is essential for preserving wealth and ensuring a smooth transition of assets. This comprehensive IRS-approved course equips you with the knowledge to implement effective estate See More

-

2025 Exploring Credits & Deductions for Maximum Impact (2 Credit Hours of Federal Tax Law)

2025 Exploring Credits & Deductions for Maximum Impact (2 Credit Hours of Federal Tax Law)Gain a competitive edge as a tax professional with our IRS-approved Tax Deductions and Credits course. This comprehensive training covers the latest strategies to maximize tax savings for your See More

-

2025 Your Top Tax Questions – Answered (1 Credit Hour of Federal Tax Law)

2025 Your Top Tax Questions – Answered (1 Credit Hour of Federal Tax Law)Tax professionals like you face complex challenges and ever-changing regulations. We gathered the top questions from tax pros like you and compiled them into this in-depth IRS-approved course. From See More

-

2025 Key Tax Law Changes: What’s In & What’s Out (2 Credit Hours of Federal Tax Law)

2025 Key Tax Law Changes: What’s In & What’s Out (2 Credit Hours of Federal Tax Law)Tax expert Doug Stives, CPA, MBA, guides you through the most critical tax updates, including adjustments to federal income tax brackets, long-term capital gains rates, and the expiration of TCJA See More

-

2025 How to Help Clients Who Haven’t Filed in Years (2 Credit Hours of Federal Tax Law)

2025 How to Help Clients Who Haven’t Filed in Years (2 Credit Hours of Federal Tax Law)Many taxpayers fall behind on their filing obligations, leading to penalties, IRS notices, and potential enforcement actions. As a tax professional, you play a crucial role in guiding clients through See More

-

2025 Installment Agreements & Offers in Compromise (2 Credit Hours of Federal Tax Law)

2025 Installment Agreements & Offers in Compromise (2 Credit Hours of Federal Tax Law)Helping clients resolve tax debts requires a deep understanding of IRS payment options and negotiation strategies. This 2-hour IRS-approved Continuing Education course, provides tax pros like you See More

-

2025 IRS Red Flags & Common Filing Errors (2 Credit Hours of Federal Tax Law)

2025 IRS Red Flags & Common Filing Errors (2 Credit Hours of Federal Tax Law)Navigating the complexities of tax compliance requires a deep understanding of IRS red flags, common filing errors, and strategic tax planning techniques. This course, led by tax expert Doug Stives, See More

-

2025 Schedule C Updates for Income Tax Filings (2 Credit Hours of Federal Tax Law)

2025 Schedule C Updates for Income Tax Filings (2 Credit Hours of Federal Tax Law)Navigating Schedule C tax reporting can be complex for sole proprietors. This comprehensive course is designed to help self-employed individuals, tax professionals, and small business owners See More

-

2025 Choice of Entity and Tax Issues (S-Corp, C-Corp, Partnership or Sole Proprietor) (2 Credit Hours of Federal Tax Law)

2025 Choice of Entity and Tax Issues (S-Corp, C-Corp, Partnership or Sole Proprietor) (2 Credit Hours of Federal Tax Law)Business creation and the evolution of hobby to business drastically influence the preparation of a client’s tax return. Many times, clients will either have questions related to entity formation See More

-

2024 Ethics Circular 230 (2 Credit Hours of Ethics)

2024 Ethics Circular 230 (2 Credit Hours of Ethics)This course offers an unparalleled look into the ethical framework guiding tax professionals. Understand the full scope of Circular 230, from conflict of interest to obligations and penalties, See More

-

2024 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)

2024 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)Stay ahead with in-depth insights into tax brackets, credits, retirement plans, electric vehicle incentives, and more with our comprehensive 3-hour course on 2024 New Tax Law Updates, tailored for See More

-

2023 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)

2023 Federal Tax Law Updates (3 Credit Hours of Federal Tax Law Updates)Learn the latest 2023 Tax Law changes. This 3-Hour course covers everything you need to know, including tax brackets, tax threshold updates, tax credits, depreciation, and special rules and unusual See More

-

2023 Ethics Circular 230 (2 Credit Hours of Ethics)

2023 Ethics Circular 230 (2 Credit Hours of Ethics)Ethics Circular 230 covers conflict of interest, ethical responsibilities, obligations, and penalties, with real-life case examples. Understand and define Circular 230, review tax returns, and gain See More

-

2024 Itemized Deductions (2 Credit Hours of Federal Tax Law)

2024 Itemized Deductions (2 Credit Hours of Federal Tax Law)This 2-hour IRS-approved course will discuss the categories of itemized deductions on Form 1040. For each category, we will discuss tax law, deduction limitations, and requirements. See More

-

2024 End-of-Year Tax Check-In and 2025 Preview (2 Credit Hours of Federal Tax Law)

2024 End-of-Year Tax Check-In and 2025 Preview (2 Credit Hours of Federal Tax Law)This comprehensive course is designed exclusively for tax preparers and Enrolled Agents. Led by renowned tax expert Dr. Bart Basi, this IRS-approved course offers critical updates and actionable See More

-

2024 Form 1099-MISC and 1099-NEC (2 Credit Hours of Federal Tax Law)

2024 Form 1099-MISC and 1099-NEC (2 Credit Hours of Federal Tax Law)This course will cover the latest updates for Form 1099-MISC and 1099-NEC, specific reporting requirements for various types of payments and payees, filing requirements, withholding requirements, See More

-

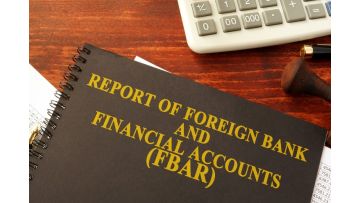

2024 FBAR, FinCEN, and Beyond: Step-by-step compliance (2 Credit Hours of Federal Tax Law)

2024 FBAR, FinCEN, and Beyond: Step-by-step compliance (2 Credit Hours of Federal Tax Law)Per the Bank Secrecy Act, every year, you must report certain foreign financial accounts, such as bank accounts, brokerage accounts, and mutual funds, to the Treasury Department and keep certain See More

-

2024 A Deeper Dive into The Most Requested Tax Topics (2 Credit Hours of Federal Tax Law)

2024 A Deeper Dive into The Most Requested Tax Topics (2 Credit Hours of Federal Tax Law)This comprehensive IRS-approved tax topic course is designed based on feedback from tax professionals like you. You told us that you want to know more about these tax topics, and now we have Doug See More

-

2024 Usual and Unusual Deductions and Tax Credits (2 Credit Hours of Federal Tax Law)

2024 Usual and Unusual Deductions and Tax Credits (2 Credit Hours of Federal Tax Law)Unlock the secrets to maximizing deductions and credits for your clients in 2024 with our comprehensive course on Usual and Unusual Deductions and Credits. As Congress continues to make Tax Law more See More

-

2024 Estate and Gift Tax Returns (1 Credit Hour of Federal Tax Law)

2024 Estate and Gift Tax Returns (1 Credit Hour of Federal Tax Law)Dr. Bart is back and ready to provide the answers to the biggest questions surrounding Estate and Gift Taxes. This course is presented by Dr. Bart Basi, a renowned tax law and financial planning See More

-

2024 Business Entity Selection and Tax Implications (2 Credit Hours of Federal Tax Law)

2024 Business Entity Selection and Tax Implications (2 Credit Hours of Federal Tax Law)Join our expert-led course, presented by Doug Stives, CPA, MBA, designed specifically for tax preparers looking to deepen their understanding of business entity selection and its tax implications. See More

-

2024 Mid-Year Wake-Up Call (2 Credit Hours of Federal Tax Law)

2024 Mid-Year Wake-Up Call (2 Credit Hours of Federal Tax Law)Join us for the Mid-Year Update with Doug Stives! This session is crucial for tax preparers aiming to enhance client outcomes and ensure their clients receive the expected refunds. See More

-

2024 Penalties, Fines, And Interest and How to Work with The IRS To Get Them Reduced And/Or Eliminated (1 Credit Hour of Federal Tax Law)

2024 Penalties, Fines, And Interest and How to Work with The IRS To Get Them Reduced And/Or Eliminated (1 Credit Hour of Federal Tax Law)Have you ever had a client who has faced IRS penalties, fines, and interest and needs to consider the next steps? Did you know that The IRS is generally willing to work with you? This course is See More

-

2024 What You Need to Know About Estate and Gift Planning – It's Not Just for the Wealthy (2 Credit Hours of Federal Tax Law)

2024 What You Need to Know About Estate and Gift Planning – It's Not Just for the Wealthy (2 Credit Hours of Federal Tax Law)This course demystifies the complexities of estate and gift planning. This session highlights that estate planning is essential for everyone, not just the wealthy. Doug Stives will delve into various See More

-

2024 Real Estate Tax Laws and Rental Property Rules Part 1 (2 Credit Hours of Federal Tax Law)

2024 Real Estate Tax Laws and Rental Property Rules Part 1 (2 Credit Hours of Federal Tax Law)Are you leveraging every tax advantage available for your client's real estate investments? This comprehensive course will explore strategic ownership decisions, depreciation benefits, tax deferral See More

-

2024 Real Estate Tax Laws and Rental Property Rules Part 2: More Laws & Guidelines (2 Credit Hours of Federal Tax Law)

2024 Real Estate Tax Laws and Rental Property Rules Part 2: More Laws & Guidelines (2 Credit Hours of Federal Tax Law)In our 2-hour course, 2024 Real Estate Tax Laws and Rental Property Rules Part 2: More Laws & Guidelines, tax preparers will gain a deeper understanding and application of the complex laws and See More

-

2024 Estate & Succession Tax Laws (2 Credit Hours of Federal Tax Law)

2024 Estate & Succession Tax Laws (2 Credit Hours of Federal Tax Law)Unlock advanced strategies in estate and succession planning to secure your clients' financial legacies. This 2-hour course is a must-attend for tax professionals looking to deepen their expertise in See More

-

2024 User Submitted Questions (1 Credit Hour of Federal Tax Law)

2024 User Submitted Questions (1 Credit Hour of Federal Tax Law)This course, presented by Lacie Henson, CPA, dives into a curriculum formed by the inquiries and dilemmas faced by tax professionals nationwide. From advanced tax law updates to practical See More

-

2024 Common Mistakes On Tax Returns And IRS Pitfalls (2 Credit Hours of Federal Tax Law)

2024 Common Mistakes On Tax Returns And IRS Pitfalls (2 Credit Hours of Federal Tax Law)Join CPA Doug Stives for an insightful course on avoiding common tax return errors and navigating IRS pitfalls. Learn how to enhance your tax filing strategies and reduce audit risks. See More

-

2024 My Client Has Not Filed a Tax Return in Years, Now What? (2 Credit Hours of Federal Tax Law)

2024 My Client Has Not Filed a Tax Return in Years, Now What? (2 Credit Hours of Federal Tax Law)Unlock the secrets to managing clients with unfiled tax returns in our exclusive webinar led by Doug Stives, CPA. Discover effective strategies for tax preparers to navigate the complexities of back See More

-

2024 IRS Dispute Resolution & Installment Agreements (2 Credit Hours of Federal Tax Law)

2024 IRS Dispute Resolution & Installment Agreements (2 Credit Hours of Federal Tax Law)Maximize your tax resolution skills with our expert-led course on navigating IRS disputes, installment agreements, and offers in compromise. Enhance your ability to secure the best outcomes for your See More

-

2023 HSA, HRA, FSA, and more year-end tax strategies (2 Credit Hours of Federal Tax Law)

2023 HSA, HRA, FSA, and more year-end tax strategies (2 Credit Hours of Federal Tax Law)Join our expert-led webinar on "HSA, HRA, FSA, and More Year-End Tax Strategies" to master healthcare benefits and tax-saving techniques. Learn about self-insured health benefits, important See More

-

2023/2024 Year-End Tax Planning and Tax Season Preview (2 Credit Hours of Federal Tax Law)

2023/2024 Year-End Tax Planning and Tax Season Preview (2 Credit Hours of Federal Tax Law)Get ready for 2024 with our 'Year-End Tax Planning and Tax Season Preview' course. We'll cover everything from practice challenges and solutions, updates in tax brackets, QCD, avoiding tax penalties, See More

-

2023 How to… report IRD & GST Part I: Income in Respect of Decedent (2 Credit Hours of Federal Tax Law)

2023 How to… report IRD & GST Part I: Income in Respect of Decedent (2 Credit Hours of Federal Tax Law)Learn about Income in Respect of a Decedent (IRD) and how to report it for tax purposes. This course will cover the definition of IRD, the types of income that are considered IRD, how to calculate See More

-

2023 How to… report IRD & GST Part II: The Generation-skipping Tax (2 Credit Hours of Federal Tax Law)

2023 How to… report IRD & GST Part II: The Generation-skipping Tax (2 Credit Hours of Federal Tax Law)Learn how to report the Generation-skipping Tax (GST) in this course. We will cover the historical background of the GST, identifying related, unrelated, and entity skip “persons,” applying the See More

-

2023 The Top 15 Reasons Why People Run Out of Money in Retirement (1 Credit Hour of Federal Tax Law)

2023 The Top 15 Reasons Why People Run Out of Money in Retirement (1 Credit Hour of Federal Tax Law)Discover the 15 common retirement mistakes and learn how to help your clients secure their financial stability in retirement. Gain insights on maximizing retirement funds and making informed See More

-

2023 Tax Laws: What Will Congress Do Next? (1 Credit Hour of Federal Tax Law)

2023 Tax Laws: What Will Congress Do Next? (1 Credit Hour of Federal Tax Law)Learn about the latest tax changes and how to protect your clients from traps and tricks with the 2023 Tax Laws: What Will Congress Do Next? course. This course is designed for tax preparers who want See More

-

2023: How To… Value Assets For Tax Purposes (2 Credit Hours of Federal Tax Law)

2023: How To… Value Assets For Tax Purposes (2 Credit Hours of Federal Tax Law)Learn how to value assets for tax purposes in this informative webinar. We will cover various valuation methodologies, charitable contributions, art appraisals, fraudulent schemes, and what makes an See More

-

2023 Evolving Retirement Law with Secure Act 2.0 (1 Credit Hour of Federal Tax Law)

2023 Evolving Retirement Law with Secure Act 2.0 (1 Credit Hour of Federal Tax Law)Learn about the challenges facing those who are planning for retirement and find out about current changes that have been made with the passing of Secure Act 2.0 to help retirees deal with a new See More

-

2023 Deductions And Credits - A Review And Analysis (2 Credit Hours of Federal Tax Law)

2023 Deductions And Credits - A Review And Analysis (2 Credit Hours of Federal Tax Law)Learn about the most important deductions and credits that you can claim for your clients on their 2023 tax returns. This course covers all of the major changes to the tax code for 2023, and it See More

-

2023 Form 1040 or 1040-NR – Which form do you file? Part 1: Immigrants & Non-resident Aliens (2 Credit Hours of Federal Tax Law)

2023 Form 1040 or 1040-NR – Which form do you file? Part 1: Immigrants & Non-resident Aliens (2 Credit Hours of Federal Tax Law)This course covers how to determine residency for federal tax purposes, report the income of NRAs, and make appropriate entries on Form 1040-NR. Plus, learn about available elections and tax credits, See More

-

2023 Form 1040 or 1040-NR – Which form do you file? Part 2: US Citizens & Resident Aliens (2 Credit Hours of Federal Tax Law)

2023 Form 1040 or 1040-NR – Which form do you file? Part 2: US Citizens & Resident Aliens (2 Credit Hours of Federal Tax Law)This course covers the filing requirements for US citizens living abroad, including the foreign-earned income exclusion and the foreign tax credit. Plus, learn about information for military See More

-

2023 The Importance of Client Engagement Agreements (2 Credit Hours of Federal Tax Law)

2023 The Importance of Client Engagement Agreements (2 Credit Hours of Federal Tax Law)Learn how to create effective engagement letters that protect you from malpractice and put your client relationships on solid footing. This course will provide you with the tools and resources you See More

-

2023 Understanding Critical Forms, Schedules, Credits, and Deductions (2 Credit Hours of Federal Tax Law)

2023 Understanding Critical Forms, Schedules, Credits, and Deductions (2 Credit Hours of Federal Tax Law)This course will teach you about tax credits and deductions, including the difference between them, how to claim them, and which ones may apply to your clients. It will also cover Form 1040 and its See More

-

2023 Common Mistakes and Missed Opportunities on Tax Returns (1 Credit Hours of Federal Tax Law)

2023 Common Mistakes and Missed Opportunities on Tax Returns (1 Credit Hours of Federal Tax Law)In this course, Doug Stives will review common tax return mistakes and missed opportunities, such as deductions, credits, dependents, medical dependents, depreciation, carry forwards, carrybacks, tax See More

-

2023 Estate Planning (2 Credit Hours of Federal Tax Law)

2023 Estate Planning (2 Credit Hours of Federal Tax Law)Estate planning is important for everyone, not just the wealthy. Tax preparers should learn the basics of estate planning to help their clients save money and protect their assets. This course will See More

-

2023 Common Questions and Tax Updates (1 Credit Hour of Federal Tax Law)

2023 Common Questions and Tax Updates (1 Credit Hour of Federal Tax Law)This course will share the most asked questions and answers among tax preparers, including important filing deadlines, tax refund questions, tax payment information, home office deductions, IRA info, See More

-

2023 Business Entity Selection and Tax Advantages & Real Estate Tax Laws (2 Credit Hours of Federal Tax Law)

2023 Business Entity Selection and Tax Advantages & Real Estate Tax Laws (2 Credit Hours of Federal Tax Law)This course covers business entity selection, real estate tax laws, limited liability companies, sole proprietorships, general partnerships, limited partnerships, series LLCs, subchapter s See More

-

2023 The Latest on Credit and Deductions (1 Credit Hour of Federal Tax Law)

2023 The Latest on Credit and Deductions (1 Credit Hour of Federal Tax Law)Get updated with the latest tax changes in 2023 and learn about essential credits and deductions, including Child Tax Credit, Dependent Care Credit, Charitable donation deductions, form 2106, See More

-

2023 Entity Selection for Small Businesses Which One is Best? (1 Credit Hour of Federal Tax Law)

2023 Entity Selection for Small Businesses Which One is Best? (1 Credit Hour of Federal Tax Law)Learn how to choose the right business entity for small businesses in this comprehensive course. Covers the different types of business entities, factors to consider when choosing an entity, and how See More

-

2023 Tax Outlook and Hot Topics (2 Credit Hours of Federal Tax Law)

2023 Tax Outlook and Hot Topics (2 Credit Hours of Federal Tax Law)This course covers tax rate updates, Qualified Business Income deductions, IRS issues, tax credits, deductions, what the inflation reduction act of 2022 has changed, S Corp updates, and more. Plus, See More

-

2023 Mid-Year Update And Wake-Up Call (2 Credit Hours of Federal Tax Law)

2023 Mid-Year Update And Wake-Up Call (2 Credit Hours of Federal Tax Law)It’s the much-anticipated Mid-Year Update from Doug Stives! If you want to make changes with your clients, if you want them to get the refund they expect, then make sure to attend! See More

Enrolled Agent Continuing Education Courses