The U.S. Tax Code can be seriously complicated. Because of this, many taxpayers don’t feel confident preparing their own federal income tax returns, even with tax software.

But using a Certified Public Accountant (CPA), an Enrolled Agent (EA), or a tax attorney to prepare a tax return can be expensive, and these professionals’ schedules often fill up early in the year.

Enter you, the tax return preparer.

These tax gurus can help prepare and file income tax returns for others without having to go through the years of schooling and testing necessary to become a tax attorney or CPA.

By completing standard continuing-education (CE) courses that provide instruction on major changes in tax law or procedure, these preparers are eligible to be listed on the IRS’s online directory of tax return preparers.

But before you can get started as a federal tax return preparer, you’ll need to complete the Annual Filing Season Program or AFSP.

Read on to learn more about the AFSP—how it works, who it’s for, and how it can benefit you.

Here’s what we’ll cover:

- What Is The Annual Filing Season Program?

- How the AFSP Works

- Who is the Program For?

- Who Is Exempt From the Program and Why?

- Course Information

- Annual Filing Season Program Costs

- Why the Annual Filing Season Program Certification Is Beneficial

- Frequently Asked Questions (FAQs)

What Is The Annual Filing Season Program?

The IRS created this program “to recognize the efforts of non-credentialed return preparers who aspire to a higher level of professionalism.”

Put another way, completion of the AFSP provides the IRS with confidence that this person can help others prepare their income tax returns, even without an advanced tax degree or certificate.

The AFSP serves a dual purpose: it allows the IRS to still regulate tax preparers who may not fall into the CPA, EA, or tax attorney "boxes," while also allowing non-credentialed tax preparers to access the same continuing-education courses available to other tax professionals. This can lower the cost of tax services to individual taxpayers and businesses.

And by taking steps to improve the accuracy of the income tax returns that are submitted, the IRS can reduce its own staffing needs and streamline the way audits and tax appeals are handled.

Tax preparers who successfully complete the AFSP can be listed on the IRS’s public database of tax professionals.

Because this listing includes up-to-date contact information, it’s a great resource for taxpayers who need a little local help. It can also be a business boon for those whose names are included in the database.

How AFSP Works

Anyone who wants to participate in the AFSP must complete 18 hours of required CE, which includes a six-hour federal tax law refresher course (with a test at the end). Remember that only courses that are labeled “IRS Continuing Education” will count toward the AFSP.

You'll also need to get (or renew) a Preparer Tax Identification Number (PTIN) each year. Without an up-to-date PTIN on file, you won’t be eligible to be included on the IRS’s AFSP database.

And because this number will identify you on each of the tax returns you prepare, using an expired number can run afoul of the IRS regulations that control who can prepare and submit a tax return on someone else’s behalf.

If you have an active PTIN but haven’t completed the AFSP, you can still complete clients’ tax returns; however, unlike AFSP participants, you’re not permitted to represent them before the IRS.

As a final step, you’ll have to agree to comply with the AFSP IRS Professional Conduct Standards. These standards are set out in Circular 230, Subpart B and Section 10.51, and include the following:

- Turning over any records or information requested by the IRS (unless the practitioner has a good-faith and reasonable belief that the records are privileged under law)

- Advising clients of the consequences of failing to correct an error or omission in their tax return (if an error or omission is suspected)

- Exercising due diligence as to the accuracy of a client’s tax returns and other tax documents.

- While everyone makes mistakes, practitioners who fail to investigate a client’s claimed income or deductions—especially when these deductions raise some red flags—can be held responsible for providing false information to the IRS.

After you’ve checked off each of these requirements, the IRS will provide you with an AFSP Record of Completion.

Who Is The Program For?

The AFSP is for anyone who doesn’t already have a professional tax preparer credential—like enrolled agents, CPAs, or attorneys—but who would like to help others complete and file their income tax returns or defend themselves before the IRS.

To participate in the AFSP, you don't need a specific degree or certificate. Instead, you'll just need to fulfill the three main requirements:

- Completion of 18 hours of required CE, including the six-hour Annual Federal Tax Refresher (unless you're exempt), 10 hours of other federal tax law topics, and two hours of ethics

- Obtain or renew your PTIN

- Agree to abide by the ethical regulations outlined in Circular 230

Who Is Exempt From The Program and Why?

Anyone who passed the original Registered Tax Return Preparer Exam in 2012-2013 (or one of a few other specific state and national tax tests) will not need to complete the six-hour Annual Federal Tax Law refresher course or its associated test.

However, all AFSP participants will still need to obtain their required 15 hours of CE each year to receive a Certificate of Completion.

These 15 hours include 10 hours of federal tax law, three hours of federal tax law updates, and two hours of ethics.

Those who are exempt from the six-hour refresher course will also need to agree to each of the Professional Conduct Standards required of other ASFP participants and have an active PTIN on file.

Course Information

When it comes to completing your CE requirements for the AFSP, My Tax Courses Online can help. We offer several 18 and 15-hour package options whether you are exempt or non-exempt.

After you've finished the last video in the course and completed the two other requirements you will be able to obtain your Record of Completion from the IRS.

Annual Filing Season Program Costs

The IRS doesn't charge AFSP participants for their participation in the program. There's also no fee to obtain a PTIN. This means that the only costs associated with AFSP completion are the cost of the required CE courses.

My Tax Courses Online offers a broad range of affordable IRS-approved AFSP courses, with seasonal sales and specials that can reduce the price even further.

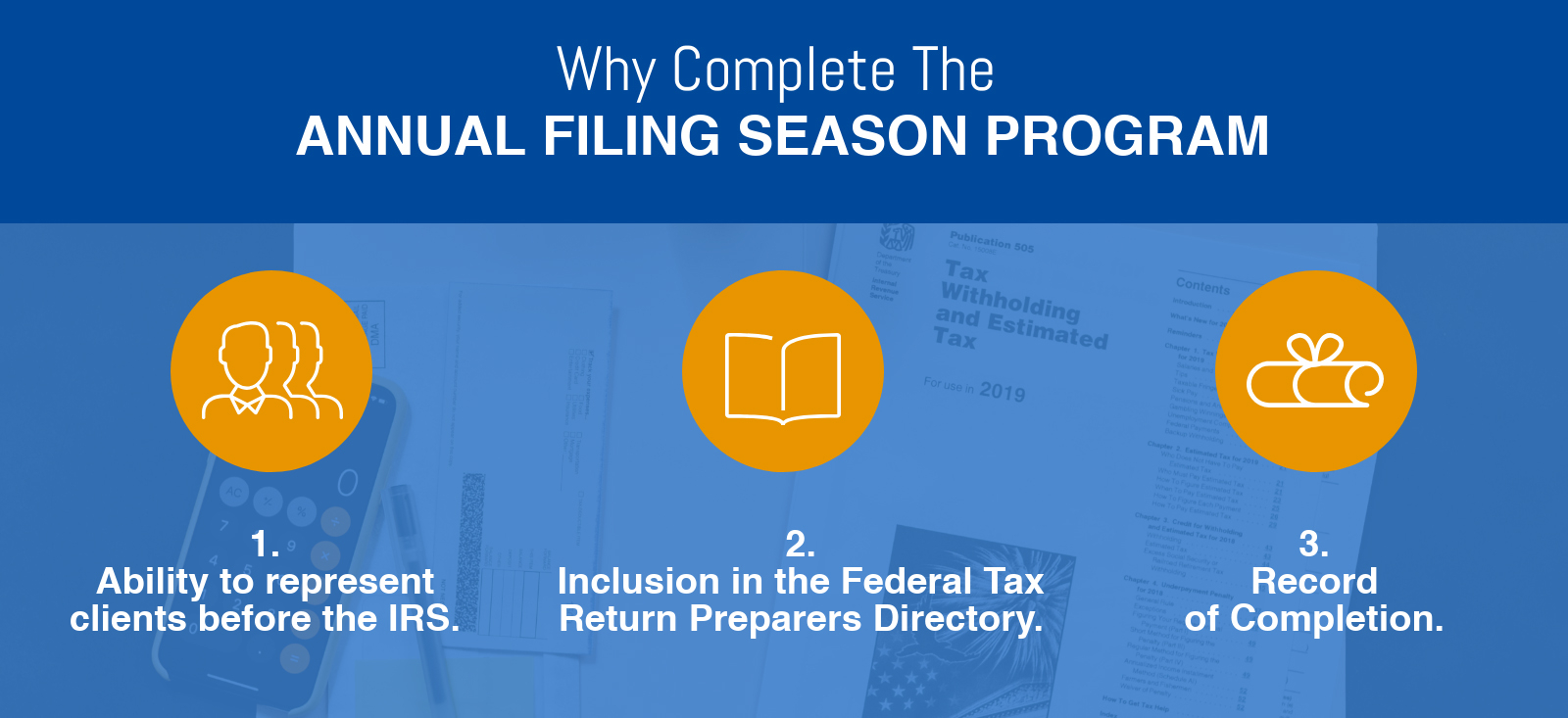

Why the Annual Filing Season Program Participation Is Beneficial

The AFSP offers three primary benefits to those who complete its requirements.

Ability to Represent Clients Before the IRS

While tax clients often seek a professional’s tax prep help because they’re not sure how to complete their own tax return, many also feel protected by the knowledge that their tax preparer will help them manage any issues that may arise later.

Without an AFSP Record of Completion, you won't be able to represent clients before the IRS.

Inclusion in the Federal Tax Return Preparers Directory

Even if you already have a dedicated group of core tax clients, the broad reach of the IRS's Federal Tax Return Preparers Directory can't be understated, especially in competitive areas.

If you'd like to grow your business or engage in more outreach during the upcoming tax season, this directory provides an invaluable opportunity to get your name out there at very little cost to you.

AFSP Record of Completion

Competing for clients with EAs, CPAs, and tax attorneys can be tough. Having a Record of Completion from the IRS can provide you with the expertise you need to set yourself apart from others in your area.

With its streamlined, straightforward requirements, the Annual Filing Season Program can benefit tax preparers and taxpayers alike.

Taxpayers gain from knowing that their tax preparer has spent the equivalent of several workdays taking a "deep dive" into current tax law.

Tax preparers can expand their client base and their knowledge base at an incredibly low annual cost.

If you're a tax preparer who is interested in getting started, My Tax Courses Online offers a broad array of IRS-approved tax courses.

Browse our website today to learn more about what we offer and to see what discounts or specials are available.

Frequently Asked Questions (FAQs)

Here you'll find the answers to some of the most commonly-asked questions about the AFSP.

Who may participate in the program?

Any unenrolled or non-credentialed tax preparer is eligible to participate in the AFSP. However, those who already have tax credentials (like EAs, CPAs, actuaries, and tax attorneys) likely won't realize any additional benefits from participating in the AFSP, and this program isn't geared toward them.

Who is exempt from taking the AFTR course & Exam?

Exemptions are available for unenrolled preparers who have completed certain other state or national competency tests that are considered equivalent to the Annual Federal Tax Refresher (AFTR). Exempt individuals include, but aren't limited to:

- Those who passed the IRS-administered "Tax Return Preparer Test" between November 2011 and January 2013

- State-based return preparers who are currently with the Oregon Board of Tax Practitioners, the California Tax Education Council, and/or the Maryland State Board of Individual Tax Preparers

- Tax practitioners who have taken and passed the Special Enrollment Exam (Part I) within the past two years

Because this list isn't an exhaustive one, other credential-holders who have questions about whether they're required to complete the AFTR should contact the IRS to confirm their eligibility.

What are the requirements to achieve Annual Filing Season Program Completion?

To complete the AFSP, you'll need to do just three things:

- Complete the required 18 hours of CE, including the Annual Federal Tax Refresher (unless you're exempt)

- Get or renew a PTIN

- Agree to abide by the IRS's ethical requirements

Will I have any other requirements to obtain the AFSP - Record of Completion?

No. The three requirements listed above—completion of 18 hours of CE, renewal of the PTIN, and agreement to abide by practice obligations—are the only things you'll need to do to obtain a Record of Completion.

What is the deadline to complete the Annual Filing Season Program (AFSP)?

In order to be included on the IRS's Federal Tax Return Preparers Directory for the next tax season, you'll have to obtain your Record of Completion by December 31 of the prior calendar year. This means that those who want to participate for the 2022 tax season will need to fulfill all requirements by December 31, 2022.

Is the AFSP Record of Completion a one-time program?

No. To renew your completed status for the next tax season, you'll need to complete the 18 hours of CE, PTIN renewal, and ethics affirmation each calendar year to stay up-to-date on recent changes in tax law that could impact your clients.

Do I have to report my course completion to the IRS?

No. As long as you've taken courses that are designated as IRS-approved, your completion should be automatically reported to the IRS. You'll then receive an email from the IRS that includes instructions for renewing or obtaining your PTIN and consenting to the IRS's ethical requirements and practice obligations. After this, you'll be issued your AFSP Record of Completion.

Will I still be able to represent clients before the IRS if I don't participate in the Annual Filing Season Program?

No. Even if you have a PTIN and have assisted clients in disputes with the IRS in the past, without an AFSP Certificate of Completion, you won’t be authorized to represent clients before the IRS. This change was enacted in 2015, shortly after the AFSP was first launched.

If you're a tax preparer who is interested in getting started, My Tax Courses Online offers a broad array of IRS-approved tax courses.

Browse our website today to learn more about the tax course packages we offer including the 18-Hour Non-Exempt AFSP Package and the 15-Hour Continuing Education Package among many other great educational tax courses!