For tax professionals, staying compliant with the IRS and meeting annual requirements like consenting to Circular 230 is essential. Here’s a step-by-step guide from My Tax Courses Online to help you navigate this process seamlessly.

Step 1: Log into Your PTIN Account

To start, log in to your IRS PTIN account. Use the official IRS website: rpr.irs.gov/PTIN.

- Click "Log In" – You'll be prompted to enter your login credentials.

- Two-Factor Authentication – The IRS requires a verification code sent to the email associated with your account.

- Be sure to check your inbox promptly, as the code is only valid for 10 minutes. It may take a moment for the email to arrive, so don’t delay once you receive it.

Step 2: Check for Unread Messages and Outstanding Actions

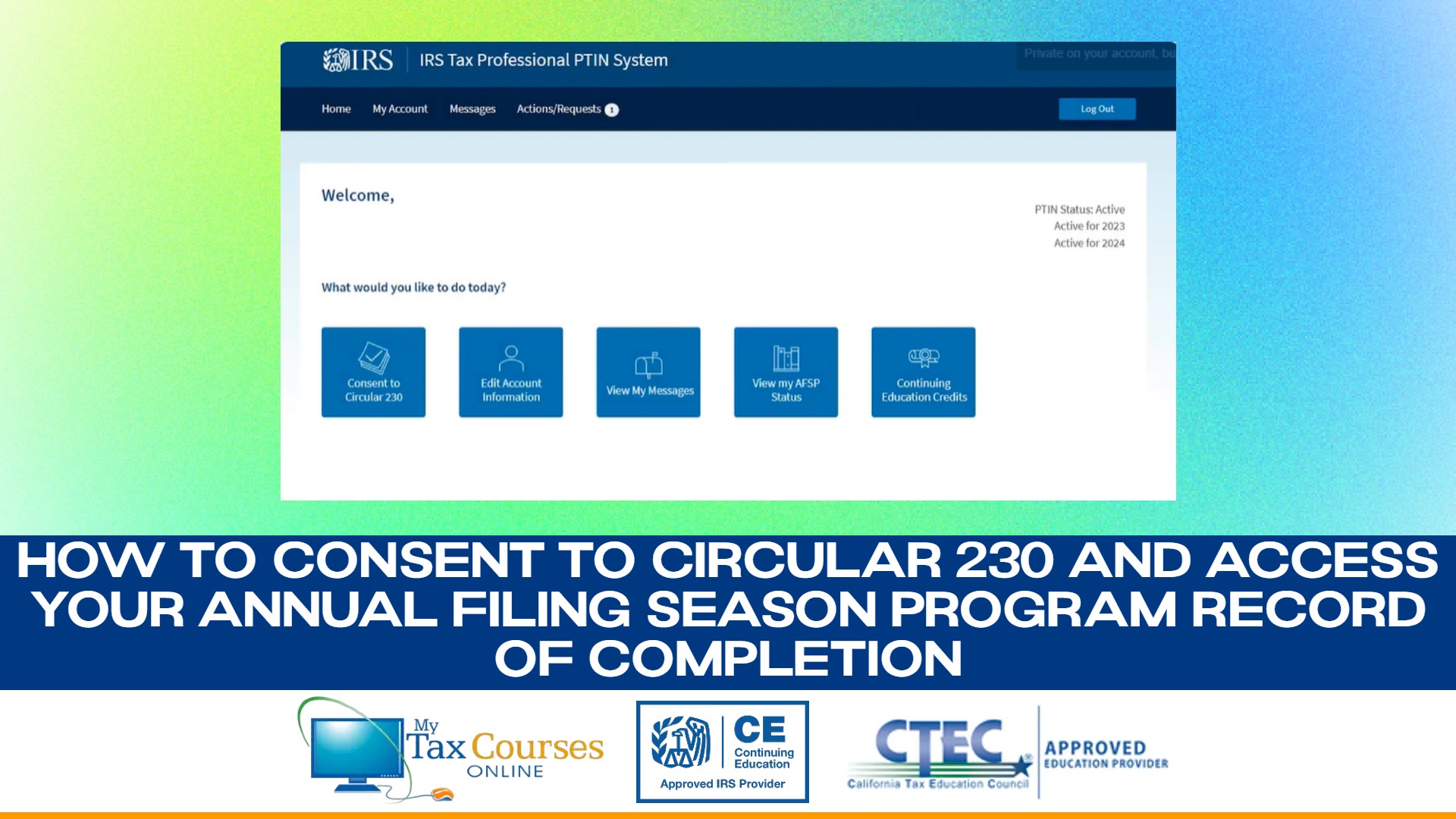

After logging in, you’ll see a dashboard with:

- Unread Messages

- Outstanding Actions

One key outstanding action will likely be the Consent to Circular 230.

Step 3: Consent to Circular 230

You can access this consent requirement in two places:

- Unread Messages – Navigate to messages indicating your eligibility for the Annual Filing Season Program (AFSP) and the need to consent to Circular 230.

- Outstanding Actions – From the homepage, click on "Consent to Circular 230."

Both options lead to the same consent form.

Providing Consent:

- Click "Consent to Circular 230" to open the disclaimer.

- Read through the IRS-provided disclaimer carefully.

- Answer the prompt, “Do you consent to the statement above?” by selecting Yes and clicking Submit.

You’ll then be required to confirm your consent under penalty of perjury, affirming that you’ve reviewed the application, understand it, and agree to the terms.

Step 4: Access Your Record of Completion

Once you’ve successfully submitted your consent and completed your PTIN renewal and continuing education requirements:

- Click on "View Record of Completion" to access your official document.

- Your Annual Filing Season Program Record of Completion for the upcoming tax year will appear in your email inbox and can also be viewed in your PTIN account.

Additional Tips:

- Track Your Continuing Education Credits – Your PTIN account provides a detailed report of the education hours you've completed. Use this feature to ensure you’re on track with your requirements.

- Renew Early – Avoid last-minute stress by completing these steps well before the filing season begins.

Completing these steps ensures you meet the IRS’s requirements for the AFSP and maintain your credentials as a tax professional. By consenting to Circular 230 and staying current on your education, you’re prepared for another successful tax season.