THE POWER OF ZERO – HOW TO GET TO THE 0% TAX BRACKET IN RETIREMENT

The tax rate in recent years has been low in comparison to previous decades. However, we know that the tax rate is set to increase on January 1, 2026. It’s a popular belief that taxes will need to go up in order for the government to continue paying its debts and obligations. After all, for taxes to go up, it requires no actions on the part of congress.

There are 3 main things that cause issues and large expenses for the government which would cause our taxes to increase:

- Social Security

- When the social security program was created, the average life expectancy was 62 and you cannot qualify for the program until you reach 65. The objective of the program was to eliminate poverty in retirement. At that time, 50% of retirees were at the poverty level. Today, that number has lowered to 10% and 96% of retirees receive social security.

- Medicare

- Baby Boomers made the largest difference in this program as well as the rising costs of medical services. Today, medical costs are outpacing wages at a significant rate.

- National Debt

- The national debt is currently over $80,000 per citizen and there are only 2 options to fix this problem. The first would be to cut spending, but we all know that’s not happening. The other option is to increase taxes, which is where we’re headed.

Plus, there are additional items that require government spending:

- Defense

- Pensions

- Stimulus

- Welfare

- Healthcare

- Infrastructure

So what can you do to help you prepare for your retirement and make sure you’re putting yourself in the best position possible?

It’s as simple as a 3 bucket system.

1. Taxable Bucket

This includes items like:

- Stocks

- Bonds

- Savings account

- CD

- Money Market

- Mutual Funds

The main purpose of keeping money in this bucket is for the liquidity factor. So how much money should you ideally be keeping in your taxable bucket? The amount you want in this bucket is enough for a 6-month emergency fund. You do not want to overfund this bucket as too much money in here can mean too much risk. But, it’s best to be careful not to underfund it either as you may need these liquid assets in order to not disrupt your other retirement plans.

2. Tax-Deferred Bucket

This includes items like:

- 401k

- IRA

- 403b

- Annuity

The average person has put a great deal of money into these items because that’s what they’ve been told to do their entire life. Part of the reason for this is because they believe they are tax-deductible. The problem with this bucket is that these items are actually tax-deferred and not tax-deductible. Without knowing what the tax rate will be in the future, you cannot be sure it’s a good decision to have your money in these items. Other issues with this bucket include the fact that you have limited access to the funds, and the uncertainty of what your tax bracket will be in retirement.

The average retiree will need 70-80% of their pre-retirement income in order to live and maintain their previous lifestyle. But going into retirement means you may start losing your old deductions like your home, children, retirement plan, and charitable contributions.

When you start losing deductions, you won’t be getting much of a benefit once you hit those retirement years. Without these deductions, you may be put into the same tax bracket that you did during your working years. Essentially, your gross income will go down but your taxable income will stay the same.

In order to benefit as much as possible, a married couple should have up to $500,000 in this bucket. For a single person, that number would be $250,000. Of course, any employer matches for a 401k should go straight into the account as that’s free money.

3. Tax-Free Bucket

When we say tax-free bucket, we mean completely tax-free.

That means:

- Federal Tax-Free

- State Tax-Free

- Capital Gains Tax-Free

- No Social Security Taxation

Many people believe that municipal bonds would go into the tax-free bucket, but they do not as if you move out of state, you’ll have to pay state taxes on these bonds and they’ll be added to your provisional income.

Let’s take a look at a case study to see how these recommendations can play out to give you the most benefits when it comes to your taxes. Of course, this is one situation and yours will not be exactly the same.

Case Study of Mr. & Mrs. Jones

Mr. & Mrs. Jones are both 55 years old and have a household income of $100,000.

Here’s a breakdown of their financials:

- IRA: $500,000

- Mutual Fund: $100,000

- 401k (no match): 10%

- Term Life: $2,000

- Long-Term Care: $4,000

If Mr. & Mrs. Jones went to a financial advisor, they’d most likely be advised to transfer their IRA and Mutual Funds for better returns and continue to contribute to their 401k until retirement, when that money would then be transferred as well. They may be able to take their IRA from 5% to 7% and their Mutual Fund from 3% to 5%

If they were able to get their IRA up to an 8% return, it would have $1,600,000 by the time the Jones’ are 70 years old. Sounds great, right? Anyone would probably think that’s a huge win and thank their financial advisor.

This should be seen as a huge red flag, though. Here’s why: Now the required minimum distribution has put you in a taxability environment for the rest of your life on distributions and social security. If taxes go up, which they will, you’ll have put yourself in a situation where you have way less money in retirement than you thought you would have.

What would be the better option for the Jones’? A 72t. This allows individuals under the age of 59 to start taking distributions out and be able to do equal amounts over a minimum of 5 years or until they are 59.5. They'll be able to use that money for whatever they’d like to. This would mean the Jones’ can pay the taxes, have no penalty, and get to that tax-free environment they’re looking for.

The Jones’ should convert $25,000 per year to tax-free per year under the 72t and transition money out of their Mutual Funds to use for the tax-free bucket.

So they’d have $47,000 they can move to the tax-free bucket.

Let’s do some quick math:

$35,000 x .30 + $10,500

Total available to convert: $47,000

Tax required to be paid: $10,500

Remaining amount to convert: $36,500

In order for this to work, you need to believe that taxes will be higher in the future and that it makes more sense to pay the money now and take the risk off of the table.

So how do you get money into your tax-free bucket?

A Roth IRA would be the best option because of:

- Annual contributions

- Increased liquidity

- Tax-free growth

The Jones’ would be able to put in $14,000.

Available balance for tax free: $36,500

Annual Roth Contribution: $14,000

Remaining Amount to Invest tax free: $22,000

They should invest the rest in a Life Insurance Retirement Plan (LIRP) which is a tax-free investment that is treated differently than any other investment you’ll find. A LIRP has:

- No penalty pre 59.5

- No 1099s

- Tax-free distributions

- Can pull money whenever they decide to do so

- No contribution limits

- No income limitations

- No legislative risk

When looking for a LIRP you should check for:

- Safe and productive growth

- Low fees

- Tax-free and cost-free distributions

- A long-term care rider

So the Jones’ Tax-Free Bucket includes:

- Roth IRA

- LIRP

- Traditional Retirement Plan

- Social Security

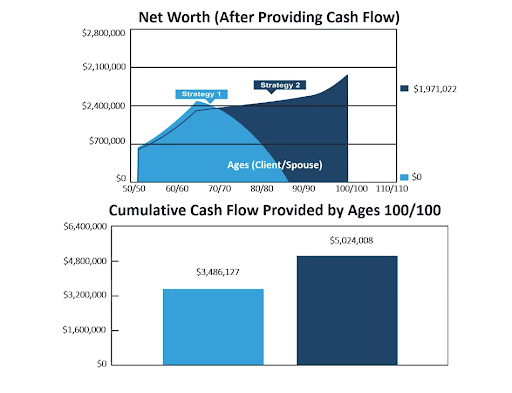

Now take a look at how the typical plan a financial advisor would suggest for Mr. & Mrs. Jones stacks up compared to our recommendations:

There’s no question that Mr. & Mrs. Jones would be in a way better position if they took our advice.

Tax-Free Investment 5 Takeaways

- Tax rates are likely to be dramatically higher

- The only way to insulate yourself is to get in the 0% tax bracket

- Need multiple streams of tax-free income for 0% tax bracket

- We know the exact day tax rates will go up

What's up next?

You can get the accompanying webinar training for this article plus gain instant access to our full Course Library Vault, and all of our past and future webinar training sessions to date. Click here to learn more about how you can use the Ultra Unlimited Package to grow your knowledge base, stay on top of the latest news, and start standing out as a tax professional.