Because the Tax Cuts & Jobs Act made so many sweeping reforms to the way individual and business income taxes are calculated, it’s crucial for tax preparers to be up to speed on the many changes this law brought. From the end of itemized deductions (in all but the rarest of cases) to an extra tax break for S corporation, LLC, and sole proprietorship income, the new U.S. Tax Code brings some major benefits (and, sometimes, drawbacks) to just about every taxpayer.

Read on to learn more about the impact of the Tax Cut & Jobs Act’s main provisions, how they've affected tax preparation services, and what every tax preparer should do to brush up on their Tax Cuts & Jobs Act knowledge before the next tax season begins.

What is the Tax Cuts & Jobs Act?

In late 2017, the Tax Cuts & Jobs Act was signed into law, with many of its reforms slated to take effect on January 1, 2018. Many of the TCJA's reforms to business taxes are permanent, while most of the reforms to personal income taxes expire in (or before) 2025.

Some of the changes enacted by the Tax Cuts & Jobs Act apply to only a small subset of taxpayers and therefore aren't widely known or written about. However, others apply to far more taxpayers. Some of these common changes include:

- The reduction of statutory tax rates and changes in the income categories within each tax bracket

- The repeal of personal and dependent exemptions

- An increase in the standard deduction for single and married filers

- An increase in the child tax credit (CTC)

- The creation of a $500 tax credit for dependents that don't qualify for the CTC

- The creation of a $10,000 cap on state and local tax (SALT) deductions

For businesses, the Tax Cuts & Jobs Act meant:

- A new 20 percent deduction of qualified business income for certain businesses, including S Corps

- The elimination of the deduction for meals and business expenses (in all but a few unique situations)

- A new 50 percent limit on deductions for business interest

- Restrictions on the definition of "like-kind" exchanges in a 1031 transaction

- A temporary allowance of 100 percent expensing for business property that was acquired and placed in service between September 2017 and January 2023. (This doesn't expire until 2027, but the 100 percent allowance will decrease by 20 percent per year from 2023 until its phase-out in 2027.)

Many businesses still aren't taking full advantage of the benefits afforded by the Tax Cuts & Jobs Act, while others may need to restructure or refinance in order to avoid a tax hit. After getting a handle on their tax bills for 2018, some businesses are meeting with a tax adviser for the first time to try to avoid similar surprises in 2020 and beyond.

Effects of the Tax Cuts & Jobs Act

Because the Tax Cuts & Jobs Act didn't directly impact individual (and certain business) taxpayers until they filed their 2018 income taxes in early 2019, the broad effects of this law are only now being realized.

On a macro level, the Tax Cuts & Jobs Act has significantly boosted job creation in the states with low (or no) state and local income tax rates.

- However, high-tax states have experienced much slower job growth, and many experts attribute this to the fact that taxpayers can no longer deduct more than $10,000 in state and local taxes. Before 2018, taxpayers in the 23 states (and D.C.) whose SALT deductions averaged more than $10,000 could seriously lower their federal tax bill to offset these higher state taxes, but the TCJA put an end to this. And although some states attempted to bypass the SALT restriction by classifying these taxes as "charitable deductions" or other non-tax deductions, the IRS issued stern guidance prohibiting these workarounds.

2019 also marked a five percent increase in the number of taxpayers who owed the IRS instead of receiving a tax refund.

- The IRS changed the income withholding tables shortly after the Tax Cuts & Jobs Act took effect, and quite a few taxpayers began to see larger paychecks as a direct result. But many of the taxpayers who didn't calculate their actual tax bill to determine whether these withholdings were still accurate got an unpleasant surprise when tax season rolled around.

- 2018 also marked an unprecedented increase in the number of tax return extensions that were filed, at just under 15 million. It's likely that many of the taxpayers filing these extension requests will owe taxes, raising this five percent increase even more.

But despite this, just about all taxpayers can derive some benefit from the increased standard deduction.

- The Tax Cuts & Jobs Act doubled the pre-2018 standard deduction for all taxpayers, in part to compensate for the elimination of the personal exemption. By raising the standard deduction for married couples from $12,000 to $24,000 and the deduction for single filers from $6,000 to $12,000 (with a Head of Household deduction of $18,000), the Act can shield quite a bit of the average household's income from federal tax.

Taxpayers who own and operate small businesses may also be able to benefit from the 20 percent deduction on business income.

- This deduction is available for most sole proprietorships, S Corps, LLCs, LLPs, and partnerships—businesses with pass-through income. For businesses that generally operate in the 22 percent-or-higher tax brackets, this deduction can shelter quite a bit of business income, especially when combined with more generous tax brackets and lower tax rates.

- For example, if you have $200,000 in pass-through income as your household's only source of income and file married filing jointly, you could get a $40,000 deduction off the top, before income taxes are even applied. That knocks you from the 24 percent bracket to the 22 percent bracket; when combined with the increased standard deduction, this could save you $10,000 or more in federal income taxes.

Taxpayers who have already engaged in some estate planning (like drafting a will, guardianship documents, or a trust) may need to revisit these estate plans in the wake of the Tax Cuts & Jobs Act changes.

- The Tax Cuts & Jobs Act changed the way certain trust and estate-division formulas are implemented, which could result in disinheriting certain relatives if these formulas aren't tweaked. With the recent rise in the stock market, many trusts have asset balances that are higher than ever, which means identifying and correcting these formula issues should be a priority.

- And for taxpayers who haven't yet crossed "get a will" off their to-do list, there's never been a better time to get started. Not only can drafting a will help protect assets and ensure they go to the proper people, but it can also save you (and your surviving family members) significant money on probate costs.

The Tax Cuts & Jobs Act has also been a boon for the tax preparation industry—although not without some growing pains.

- The IRS reported a 13 percent increase in the volume of phone calls to its taxpayer helpline for 2018. While some of these taxpayers went on to file their own tax returns (either solo or with the use of tax software), many enlisted the help of a tax preparer, some for the first time.

- With many last-minute changes, corrections, and tweaks to the Tax Cuts & Jobs Act, along with limited federal guidance on what these changes meant for taxpayers, preparers had a tough time keeping up with these changes while handling their regular tax-season duties.

What the Tax Cuts & Jobs Act Means for Tax Preparers

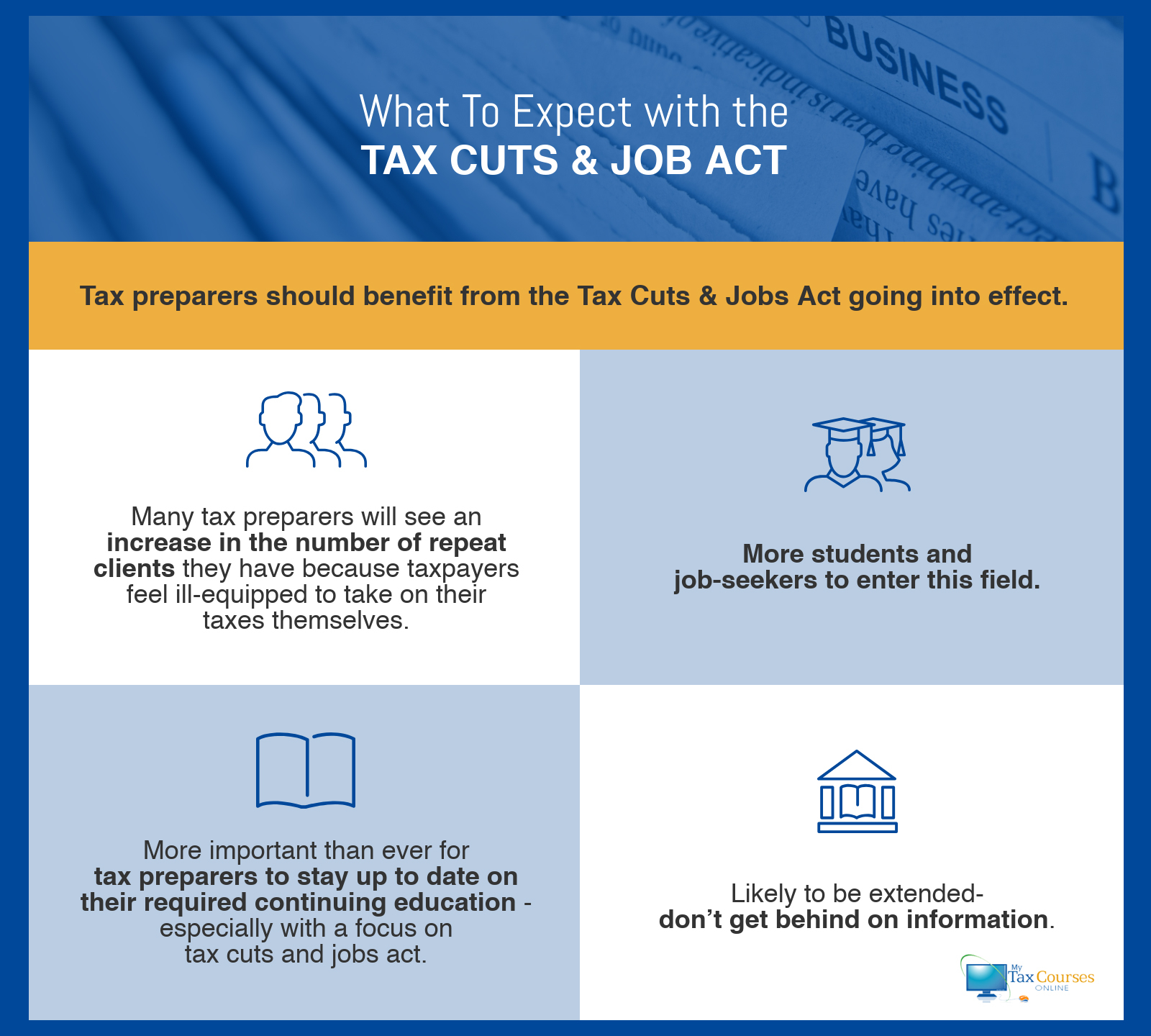

In the long run, tax preparers can and should benefit from the Tax Cuts & Jobs Act. Taxpayers who feel ill-equipped to tackle their taxes themselves and who use a tax preparer for the first time can quickly realize how helpful it is to have the guidance of someone who knows the ins and outs of the U.S. Tax Code. Many tax preparers will see an increase in the number of repeat clients they have.

It's likely that the significant increase in the number of taxpayers (and small businesses) who use tax preparation services will encourage more students and job-seekers to enter this field. This could increase competition over the next few years. With so many of the Tax Cuts & Jobs Act's changes scheduled to remain in effect until the mid-2020s, there's still plenty of time for new tax preparers to get started.

And the Tax Cuts & Jobs Act isn't a static law. As with every sweeping piece of legislation, there are unintended consequences that need to be corrected, and legislators have been hard at work tweaking the law to better reflect their original intent. Because many of the individual tax cuts and changes expire in the mid-2020s, after at least two more national elections, it's likely that the Tax Cuts & Jobs Act will be extended or continued in some form even beyond this point.

This makes it more important than ever for tax preparers to stay up to date on their required continuing education (CE), with a particular focus on Tax Cuts & Jobs Act updates. Taking a "one and done" attitude toward the Tax Cuts & Jobs Act after familiarizing yourself with the 2018 changes could mean operating with outdated or incorrect information.

How to Prepare for Tax Season

The 2020 tax season is coming up before you know it, and with Congress back in session at the end of summer, it's likely that more changes are on the way. It's important for all tax preparers to get up-to-speed on updates to the Tax Cuts & Jobs Act so that they can advise their business and individual clients on how best to maximize their tax savings for the upcoming year.

My Tax Courses Online offers a free update course that counts toward your Annual Filing Season Program (AFSP) record of completion. With no cost to complete, this course is a no-brainer, especially for tax preparers who plan to participate in the AFSP (and be listed on the IRS's registry of enrolled tax preparers) for the 2020 tax season.

My Tax Courses Online also has a wide array of Tax Cuts & Jobs Act-focused courses, from refreshers on business income taxation to courses that are focused on individual taxpayers' needs. Even if you haven't stayed on top of the Tax Cuts & Jobs Act changes, you can quickly familiarize yourself with them by taking some of the courses available on MTCO's website.

In Closing

It's undisputed that the Tax Cuts & Jobs Act's changes are the most sweeping the U.S. Tax Code has seen for generations. Tax preparers who want to remain viable in an increasingly competitive field should make it a priority to stay up to date on Tax Code changes, from the initial implementation of the TCJA to the updates likely to take effect during each new tax year. Maintaining expertise on all the most recent Tax Cuts & Jobs Act changes can encourage client loyalty and increase the number of word-of-mouth recommendations you receive.

My Tax Courses Online can help. With thousands of hours of IRS-approved video courses available online, My Tax Courses Online has all the most current information about Tax Cuts & Jobs Act changes. And because these video courses are available through an easy download, you're free to complete them at your own pace and on your own schedule, printing out your record of completion as soon as you're finished.