This VIP offer is brand new for 2022! We’ve put together 15 hours of the top tax video courses featuring Dr. Bart Basi, Roman Basi, Lacie Henson, Monica Haven, and more. The best in the tax world is here to explain, in plain English, everything that has changed for 2022 and what has stayed the same. These courses are all IRS-approved.

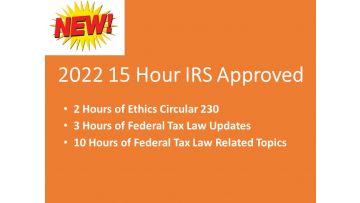

The 15 hours contained in this package include:

- 2 Hours of Ethics

- 3 Hours of Federal Tax Law Updates

- 10 Hours of Federal Tax Law Related Topics

This package covers all major changes and topics that affect all taxpayers.

Course titles included in this package:

- 2022 Ethics Circular 230 (2 Credit Hours of Ethics, with English and Spanish, closed captioning)

- 2022 Federal Tax Law Updates (3 Hours Federal Tax Law Updates, with English and Spanish, closed captioning)

- 2022 Community Property Issues (2 Hours of Federal Law)

- 2022 Form 709: The Gift Tax Return (2 Hours of Federal Tax Law)

- 2022 Forms, Schedules, Deductions, and Credits (2 Hours of Federal Tax Law)

- 2022 Understanding the Child Tax and Education Credits (2 Hours of Federal Tax Law)

- 2022 IRS Dispute Resolution and the Opportunity Zone Tax Credit (2 Hours of Federal Tax Law)

What is the benefit of participating in the Annual Filing Season Program (AFSP)?

- Your name is listed in the Directory of Federal Tax Return Preparers with Credentials and Select Qualifications that will be available every January.

- You will have certain representation rights for the tax returns you prepare and sign.

- You are dedicated to remaining current with changing tax laws.

- You will receive the AFSP – Record of Completion that proves to your current clients and potential clients that you are a well-educated tax preparer who understands and implements the tax law updates that occur each year.

What is the deadline to complete the Annual Filing Season Program (AFSP)?

The approved continuing education program must be completed within the calendar year to qualify for the filing season.

What are the requirements for the Annual Filing Season Program Record of Completion?

- Completion of courses from an IRS-approved provider, like My Tax Courses Online, will satisfy the completion.

- The yearly requirement for Exempt status tax preparers is 15 hours. This consists of 10 hours of federal tax law continuing education credits, 3 hours of tax law updates, and 2 hours of ethics.

- The yearly requirement for Non-Exempt status tax preparers is 18 hours. This consists of a 6-hour Annual Federal Tax Refresher (AFTR) course and test, 10 hours of federal tax law continuing education credits, and 2 hours of ethics credits.

- For more information, please view the following IRS document. CLICK HERE.

Who may participate in the program?

- Anyone with a preparer tax identification number (PTIN) is eligible to participate in the Annual Filing Season Program Record of Completion program.

- CLICK HERE to see the IRS FAQ for further details.