Course Summary

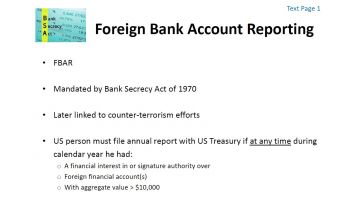

Do we really have to file both the FBAR and Form 8938?! This session distinguishes between foreign accounts and foreign assets, reviews reporting thresholds, outlines the harsh consequences for non-compliance, and provides a comparison of relief programs including OVDP and the Streamlined Disclosure Program. Learn what to do to ensure that your clients satisfy their foreign reporting obligations and what to do if they don’t.

Learning Objectives

Upon completion of this course, you will be able to:

- Identify when a taxpayer has a foreign reporting obligation.

- Recognize the overlap of reporting mandates stemming from regulations enacted decades apart.

- Compile the information necessary to properly report foreign accounts and assets.

- Implement best practices to help clients avoid penalties and potential criminal prosecution.

- Understand the options available to those who have been non-compliant.